The Complex Relationship and Looming Crisis Between Our Thirst For Water and Our Hunger for Energy

April 15th, 2015

Via China Water Risk, an overview of a new report on watergy in China:

China’s waterscape is changing. Water risks in China, be they physical, economic or regulatory, have great social-economic impact and are well recognized. China Water Risk (CWR) has encouraged a comprehensive view of such water risks since our launch in October 2011 with the aim of increasing the understanding and thereby the mitigation of such risks.

CWR believes that water cannot be considered alone, that an unsiloed approach to the challenges China faces relative to water is critical. Thus water and energy has of necessity been a key area of focus.

We can no longer ignore that rapid industrialization and rising affluence, along with an increasingly complex water-energy nexus, has put mounting pressure on the supply of water.

93% of power generation in China is water-reliant

Meanwhile, water scarce provinces (similar water resources to the Middle East) generate around half of China’s GDP

Today, power generation is the largest user of industrial water. In fact, 93% of power generation in China is water-reliant. In short, no water = no power and vice versa as we require power to clean, transport and distribute water.

Moreover, China’s water resources, arable land and energy reserves are mismatched: many of the nation’s large coal mines lie next to the North China Plain, the country’s agricultural heartland. Many of these areas also have limited water.

In China, water scarce provinces (with water resources similar to the Middle East) generate nearly half of China’s GDP, almost 40% of total agricultural output value and hold over half of China’s ensured coal reserves.

Rampant pollution has also exacerbated water scarcity and brought about concerns over soil pollution and food safety. It is inevitable that there will be conflicting needs for limited water in the future.

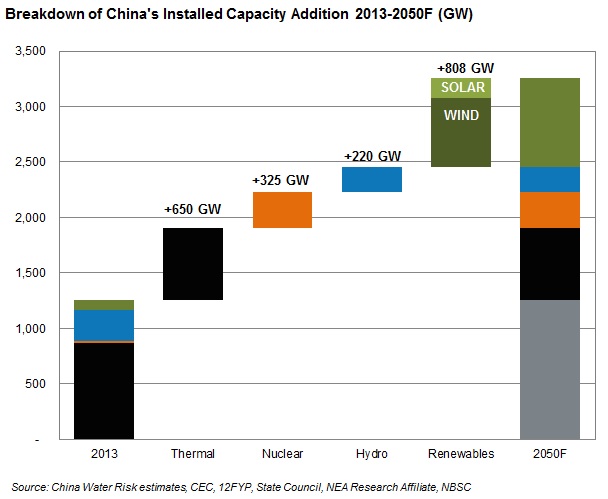

China is still hungry for thirsty power. At 0.87kW, China’s per capita power generation installed capacity is still far below that of the G20 average. By 2050, China could add 2TW of installed capacity – this is more than the current total installed capacity of the US, UK, France, Germany, Russia and Japan combined.

Despite this staggering expansion, China’s per capita installed capacity will only rise to 2.6kW by 2050 which although in line with Japan’s 2.3kW/capita in 2012, is far below that of the US of 3.4kW/capita for the same year.

Can China manage this magnitude of power expansion with limited water resources?

By 2050, China could add 2TW of installed capacity…

… this is more than the current total installed capacity of the US, UK, France, Germany, Russia and Japan combined

Coal to remain the vanguard

Coal’s share of total installed capacity is forecasted to fall below 50% by 2050 … yet there is still significant expansion in China’s coal-fired fleet in absolute terms

The power sector’s water risk exposure is great. Coal is currently China’s vanguard fuel yet public concern over air pollution has led to official commitments to reduce reliance on coal. However, despite the fact that coal’s share of total installed capacity is forecasted to fall below 50% by 2050, China is still looking at a significant expansion in its coal-fired fleet in absolute terms.

Already water used in coal extraction and production as well as coal-related industries including coal-fired power generation is estimated to account for over half of industrial water use in China.

Concerns over whether China has the water to extract and produce coal to meet these ambitious targets have been raised. The Ministry of Water Resources has even issued a Water-for-Coal Plan limiting the development of large coal bases subject to regional water availability.

We seek to address these water risks in this report by building on our two previous groundbreaking report collaborations with HSBC and CLSA on power generation and coal mining respectively. In addition, we have included water risk exposure profiles for coal-fired power generation, hydropower and nuclear power. Hidden and little talked about water risks brought on by aggressive wind and solar power expansion as well as other renewables are also detailed.

China’s water-energy-climate nexus: A fine balancing act

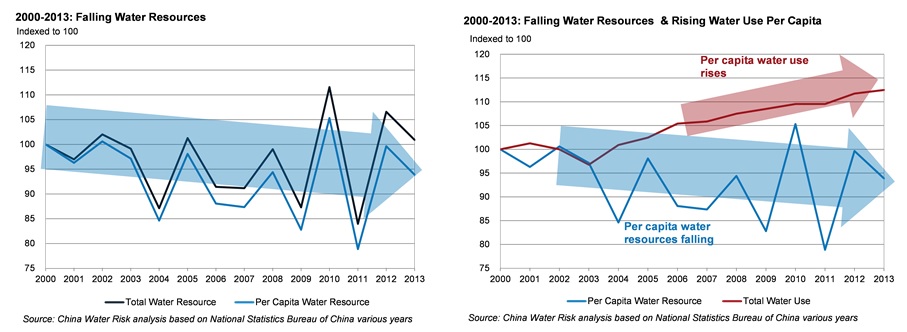

Water in China also increasingly is interlinked with climate issues. The rise of extreme weather events exacerbates water scarcity and divergent trends in water use and resources indicate a thirstier future:

China is affecting water resources through direct use but also indirectly through climate change impact as a result of carbon emissions

With around three-quarters of China’s electricity generated by coal, electricity generation in China is affecting water resources not just through direct water use but indirectly through climate change impact as a result of carbon emissions.

Getting the power mix right by balancing water use, carbon emissions and their electricity generation capabilities is imperative. Achieving economic growth, social stability and ecosystem integrity is a fine balancing act for the government.

Unfortunately, climate solutions in energy such as carbon capture and storage may not be available to China due to their large water requirements and carbon-friendly, hydropower, bioenergy and concentrated solar power all require water to generate power. Meanwhile some water supply solutions such as desalination and water diversion are power intensive.

“There are no one-size-fits-all solutions …

…China will do whatever it takes to ensure water security, because only with this comes energy and food security.”

There are no one-size-fits-all solutions to China’s water-energy-climate nexus. More importantly, China’s energy choices do not only impact global climate change but affect water availability for Asia: more coal could accelerate glacial melt and more hydropower could lead to water wars given the region’s transboundary water resources including the Brahmaputra, the Mekong, the Salween and the Indus rivers.

Trade-offs between electricity generation, climate & water need to be examined holistically. Given these challenges as well as the rise in competition for water resources between energy & food, this report explores strategies towards water and energy security in China with climate & food security in mind.

Multiple strategies adopted can be grouped into a three-prong approach

No country can afford a water supply crisis let alone a food and energy crisis. China will do whatever it takes to ensure water security, because only with this comes energy and food security.

Multiple strategies will have to be adopted simultaneously across a broad spectrum of sectors. Already there are many such policies in place. In this report, we have grouped these strategies into a broad three-prong approach to facilitate understanding. Each of these “strategy-prongs” are detailed in a separate chapter.The three strategies are:

1. Balancing power mix by considering trade-offs among water, energy & climate;

2. Controlling water use in agriculture, coal mining & coal-related sectors to ensure food & energy security; and

3. Curbing energy demand as saving power means saving water.It is important to note here that these strategies will not just impact the power sector.Industrial exposure is also significant with Chinese industry driving 85% of China’s electricity consumption. Direct exposure of China’s industrial backbone to water scarcity and pollution coupled with indirect exposure through water-reliant electricity consumption means a double whammy for multiple industries.

Multiple industries face a double whammy exposure to water risk

Steel and cement sectors which are power intensive and require coking coal as input should pay particular attention. Consequently, there are serious implications for business continuity. Investors and providers of long-term capital to industry are particularly exposed to such risks.

China’s energy mix is evolving; Aggressive add of non-water-reliant power brings hidden water risks

China’s energy mix is evolving. Already China has plans to shift its energy sources away from coal and hydropower towards less water-reliant power such as wind and solar. Water-reliant power is projected to fall from 93% to 72% by 2050. However, the magnitude of China’s power expansion still means +1.2TW of water-reliant power, equivalent to 4x the total installed capacity of Japan.

“Water-reliant power is projected to fall from 93% to 72% by 2050.

However, the magnitude of China’s power expansion still means +1.2TW of water-reliant power…

… equivalent to 4x the total installed capacity of Japan.”

Nevertheless, an energy secure future in China includes the ability to supply electricity without having to rely on other countries for fuel. As such, coal will remain the vanguard due to the country’s vast coal reserves, pointing to the need to prioritise improvement and investment in water use along the whole coal chain. Also, mixed views on the availability of water for coal in China indicate the need for more disclosure and transparency in large coal bases.

Coal stays as the vanguard but needs more disclosure & transparency in large coal bases…

…Nuclear is at a crossroad with contamination fears…

…Hydropower remains a staple but raises geopolitical risks…

On the other hand, nuclear, although carbon-friendly, is at a crossroad due to water contamination fears brought on by inland nuclear power expansion in densely populated areas such as the Yangtze River basin.

Hydropower’s dual role of power generation and water flow management means it’s here to stay, but the increasing role of dams in assuaging droughts and providing flood relief, worry downstream neighbours.

Finally, wind and solar will dominate renewable growth but improper treatment and illegal discharge of toxic wastewater and radioactive waste from rare earths required in their manufacture bring hidden water risks for important watersheds in China. The Yellow River which feeds the North and the Dongjiang River, which supplies water to important cities such as Guangzhou, Shenzhen and Hong Kong are particularly exposed to such threats.

… Improper treatment & illegal discharge of toxic wastewater & radioactive waste from rare earths used to make wind turbines threaten key watersheds

Clearly current mining practices in rare earth ores as well as rare earths production need to be addressed, but this is not just China’s problem as “made in China” supplies the global movement for a renewable future.

In 2012, China accounted for 90% of global rare earths production; thus reliance on China is unavoidable. Japan and the US are China’s largest trading partners. The global rare earths and renewable industries need to reinvent themselves. China’s trading partners should bear some responsibility and work with China to find ways to minimise potentially disastrous impacts on China’s key watersheds.

In the most aggressive expansion scenario of wind capacity for China alone, the accumulative wastewater generated by the increased demand in rare earths could rise by 20x.

High stakes: Regional watershed implications and global climate ramifications

There are clear water risks for China and by extension for all of us. Tough choices lie ahead on the road towards a water and energy secure China. In reality, dispersed authority and overlapping responsibilities may hamper the right choices for water, energy and climate. Navigating China’s water energy nexus is complex and implementing strategies to address it, a long uphill battle. We hope this report helps facilitate understanding of these challenges and their global consequences.

The stakes are high, glaciers are melting and there are global ramifications

It’s time to start productive conversations to find solutions

With glaciers in the Qinghai-Tibetan Plateau shrinking 15% over the last three decades, the stakes are high. The future of China’s energy mix doesn’t just impact China; it has regional watershed implications and global climate ramifications. It is time to start productive conversations to find solutions for Asia’s water-energy-climate nexus. As the upstream riparian, China will no doubt play the central role in regional water security.

Can it ensure water & energy security whilst keeping climate change in check and at the same time side-step transboundary conflict? It’s time to take a closer look.

Further Reading

- China: Not Ready To Move Away From Coal – Professor Xie Kechang, Vice President of the Chinese Academy of Engineering, on the future role of coal, strategies to ensure energy security & challenges ahead for coal-to-chemicals

- Balancing Water For Agri & Coal – China’s coal mines lie next to its farmlands and it plans to save water used in agriculture to fuel coal growth. In “Towards a Water & Energy Secure China”, China Water Risk explores strategies to control water use between agriculture & coal to ensure both food & energy security

- China’s Pursuit Of Energy Savings – Our report “Towards A Water & Energy Secure China” shows that billions of cubic metres of water can be saved via energy savings. See why China has no choice but to pursue this strategy

- Wind & Solar: Hidden Water Risks – China is looking at aggressive renewable expansion with wind & solar set to soar. But could this intensify toxic hidden water risks from rare earth mining? Also some solar technologies require more water than coal to generate power. We explore these hidden risks in our report “Towards A Water & Energy Secure China”

- China Nuclear: The Future is Unclear – Will China’s nuclear ambitions be thwarted by water risks and contamination fears? China Water Risk explores inland nuclear expansion and alternative scenarios for densely populated regions in our report “Towards a Water & Energy Secure China”

This entry was posted on Wednesday, April 15th, 2015 at 4:59 pm and is filed under Uncategorized. You can follow any responses to this entry through the RSS 2.0 feed. You can leave a response, or trackback from your own site.

Leave a Reply

You must be logged in to post a comment.

Educated at Yale University (Bachelor of Arts - History) and Harvard (Master in Public Policy - International Development), Monty Simus has held a lifelong interest in environmental and conservation issues, primarily as they relate to freshwater scarcity, renewable energy, and national park policy. Working from a water-scarce base in Las Vegas with his wife and son, he is the founder of Water Politics, an organization dedicated to the identification and analysis of geopolitical water issues arising from the world’s growing and vast water deficits, and is also a co-founder of SmartMarkets, an eco-preneurial venture that applies web 2.0 technology and online social networking innovations to motivate energy & water conservation. He previously worked for an independent power producer in Central Asia; co-authored an article appearing in the Summer 2010 issue of the Tulane Environmental Law Journal, titled: “The Water Ethic: The Inexorable Birth Of A Certain Alienable Right”; and authored an article appearing in the inaugural issue of Johns Hopkins University's Global Water Magazine in July 2010 titled: “H2Own: The Water Ethic and an Equitable Market for the Exchange of Individual Water Efficiency Credits.”